15 Jul IS IT TIME TO END SALARY SECRECY?; MUSK’S MESS

Welcome to this week’s business and media intelligence update.

IS IT TIME TO END SALARY SECRECY?

Australia’s tight labour market just got a whole lot tighter with unemployment plunging to 3.5 per cent – its lowest point since August 1974, way back when Gough Whitlam was PM and ABBA had a smash hit with Waterloo!

So, what does this mean for companies struggling to attract – and keep – skilled workers? Some employment recruiters believe firms will have to start revealing salary brackets if they want an extra edge in the race to fill job vacancies.

Pay transparency isn’t a problem for bosses at the big end of town, however. An Australian Council of Superannuation Investors report this week revealed that Afterpay’s co-CEOs and founders, Anthony Eisen and Nick Molnar, were Australia’s highest-paid executives in 2021, taking home a combined $264.2 million, while CSL’s boss Paul Perreault was in second place with $58.9 million.

MUSK’S MESS

Elon Musk’s takeover shenanigans with Twitter are being blamed for damaging not only the social media giant’s brand, but for also driving customers and investors away from Tesla.

The share prices for both companies have taken a battering since Musk made his controversial takeover play for Twitter in April and stepped up his public criticism of the platform.

Musk has been accused of eroding trust in Twitter, denting employee morale and spooking advertisers, while some motorists reportedly won’t be buying a Tesla electric car any time soon because they find Musk such a divisive character.

VIRTUAL GOODBYES

Remote working has altered every stage of employment – including the end, with some companies using the video platform Zoom for mass sackings.

Many big businesses – including US mortgage company Better.com, P&O Ferries and Swedish fintech Klarna – have been terminating hundreds of workers in recent months via group video calls.

They’ve justified the virtual terminations for various reasons: the pandemic, sluggish growth, heightened labour costs, and efficiency.

Unsurprisingly, these virtual layoffs only generate bad publicity and leave staff angry. But as remote work looks like it’s here to stay, will virtual terminations also stick around?

SAY WHAT?

ETF, blockchain, high-yield bond … what?

A YouGov survey, commissioned by Cannings, has found that almost half of all Australians struggle with financial literacy and most find it near impossible to understand the information provided by financial institutions.

There is a clear message in these figures for our financial institutions to help Australians make more informed financial decisions: provide clear, effective, and accessible communication. And it can be as simple as putting complex terms into plain English.

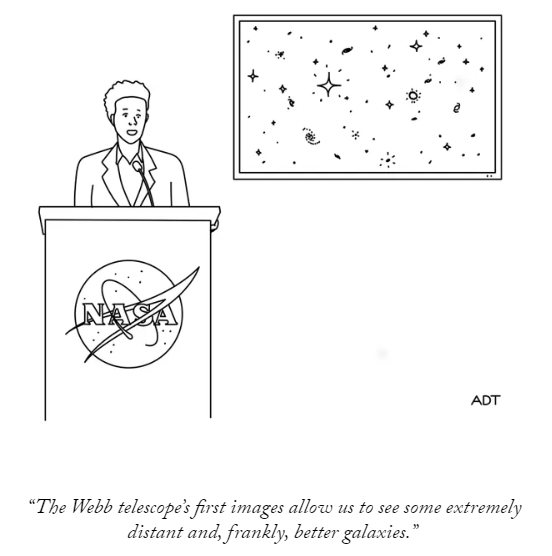

ONE MORE THING…

Source: The New Yorker

Feel free to share these updates with colleagues or friends. They can sign up here to receive our daily newsletter.